The Two Aspects of Scaling

It was a winter evening in 2017 and we were in a small office that was being renovated. I was acting in my role as a coach, helping executives of medium-sized companies scale. Nothing had prepared me for what Paul announced several minutes into our conversation, “I’m almost fifty-five years old. I think I’m going to step down in four or five years after selling the company.”

I was surprised. Why did this talented businessman want to leave a successful family business instead of ensuring its sustainability and laying a foundation for his children to take over? It is said that a company takes root during the first generation and then comes into its own during the second. This example perfectly illustrates that particular adage. Succession was assured, the company had reached maturity, management was ready to take over, and the company’s finances were well-managed. So where did this sudden desire to disengage come from? A friend of the family, I felt free to ask this question.

Paul offered several explanations: “My kids have their own projects. And I would like to see these twenty-five years of hard work come to fruition. Today, the market is very interested in companies like ours—that deal in data. But who is to say that this will always be the case?”

He had obviously spent a long time developing these three arguments. My mission, however, is to use scaling to make the adventure a successful one, rather than talking about a company’s raison d’être. I continued my query of Paul, “Excellent! And what value would you assign to your efforts?”

“At least 30 million. That would be an outstanding exit.”

“Okay. And how do you expect to get to that figure?”

His mind was made up. He had carefully worked it out. Like Roger Federer on the tennis court, he grabbed his computer and, on the fly, created an Excel table with several dozen rows. He highlighted this in bold: “With a multiple of 12, we should generate an EBIT of €2.5 million within five years if we want to win the bet we’ve made.”

“Uh, okay. And what’s the current value?”

“Well…it’s €15 million.”

Paul wanted to double the value of his company in five years. He was in for a big surprise. In fact, the plan was going to greatly exceed his expectations because the 15 million could be tripled…within one year!

I flesh out this exciting plan below, point by point. But let’s take a moment to look at valuation techniques. While they are quite well known to multinational companies valued using marketcapitalization, medium-sized companies do not understand them very well. The question is, should these companies base their valuation on EBIT, recurring revenue, or even on the assets they hold?

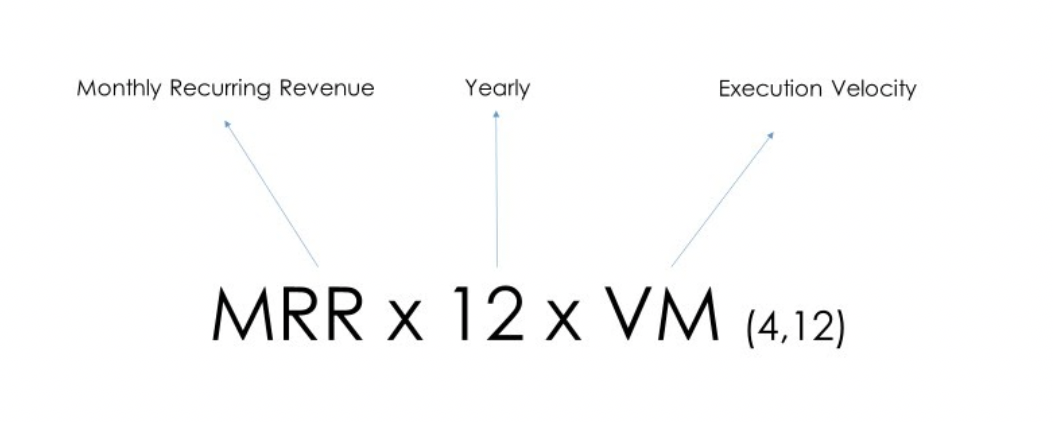

A valuation using EBIT does not make sense since substantial investment will affect a company’s net profit in the short term. Conversely, a valuation that uses recurring revenue and increased production capacity is perfectly suited to this case. The method for valuing start-ups in growth mode is, therefore, much more relevant for use by medium-sized companies who are in the process of scaling. It can be summed up in a simple formula often used by the software industry. It has two factors: monthly recurring revenue (MRR) and execution velocity (VM).

Monthly Recurring Revenue (MRR)

Monthly recurring revenue is the amount of sales generated by clients who have subscribed to a product or multi-year contract. As I mention above, MRR has long been considered the foundation of companies who offer Software-as-a-Service (SAAS) to sell their applications. In recent years, it has also become a key indicator for any entity in strong growth mode.

By definition, recurring revenue is a long-lasting asset. This is also true for valuation: a periodic contract worth $80,000 is often worth less than a monthly per user subscription of $390. It is, in fact, the subscription that will ensure an “automatic” revenue base for years to come.

Let’s return to Paul’s story. During our discussion, I was concerned when I reviewed the company’s client list: three hundred prestigious clients in the food-processing industry with very few recurring contracts to ensure the company’s long-term sustainability. The question was how this should be addressed.

Concretely, there are three possible paths to increase the MRR:

- launching a new product;

- investing in a new market;

- changing the business model.

The easiest approach is to rework the business model and focus on selling complimentary “modules” to ensure client loyalty for the long-term. This technique is 150 years old and still works extremely well today. It’s known as the razor and blades business model. Its founder, King Camp Gillette, was a visionary. He rejected the idea of selling an expensive product once. For example, take the tennis racket. He preferred to come up with a product at an accessible price (a razor) but the use of which depended directly on a complimentary module (the blade). His design required the consumer to buy blades in a regular and systematic fashion. A fantastic source of recurring revenue!

This successful model, has, since, been used extensively. Sony developed an inexpensive game console—the PlayStation is sold at a loss—accompanied by interchangeable games and resulting profits generated. Nespresso follows the same logic with its coffee machine and capsules. The same is true for HP with printers and ink cartridges.

Great news: it is possible to apply the same strategy no matter the product being sold! This is what we were anxious to accomplish for Paul’s company. We separated his flagship product (a database software application) from the related module (a system for scoring relevance). The average contract for the North American branch then increased by 340% in one year.

Think about it! Does your business model encourage the sale of recurring modules?

The second option, an approach that must be executed more carefully, is to penetrate a new niche market. To be clear, from an infrastructure perspective, integrating a new geographic area often requires a very large investment. In contrast, a niche market offers the advantage of providing a source of additional revenue without the need to commit substantial funds.

To return to our example, we were comfortable with our section of the market made up of manufacturers and agribusinesses like PepsiCo, Unilever and McCain. But in the summer of 2018, we were betting on expansion. In Europe, we implemented a classic penetration strategy in new geographic areas (The United Kingdom, Germany, Spain, Belgium, The Netherlands, Italy, Scandinavia). The investment was too large for a delayed return on investment. Learning from this experience, we tried a more disruptive approach in the United States. In the US, we launched the company into a niche market within an existing geographic area: technological providers within the food-processing industry. We began by discovering what the frustrations of the clients in this market were—we figured out their pain points. Then we highlighted the product adapted to serve as the solution and defined the added value that enabled us to differentiate ourselves from other data providers within this sector. Within four months, we had signed multiple contracts with some of the largest players in the industry (UberEATS, DoorDash, Restaurant Technologies, Zume Pizza and others). For a ridiculously low investment, recurring revenue grew by 60%.

The third possible approach is to finally launch a new product that has the potential to generate recurring revenue within an existing market. This approach is definitely the most difficult to carry out. But it is powerful. If innovative processes are generally very time-intensive and have a significant failure rate, expertise in rapid prototyping is a major advantage when scaling.

Let’s look at an example. At the beginning of September, one of our long-time clients had expressed an urgent need to prioritize the thousands of target restaurants on whom we provided data to this client. About a month later, another client who is a major distributor in this industry, wanted to achieve economies of scale on the time its sales force spent on travel. For the first, we could imagine a target priority score created from a set of parameters. We could apply a travel optimization system to the second. In both cases, the process is similar: once the need has been identified, we can start creating a digital mock-up to be submitted to the client describing the exact benefit to be gained. When the client gives the approval, product development begins. This is an extremely short innovation cycle but it is very effective. We then sold these two additional features and immediately garnered a profit of $200,000, with Goldman Sachs as the first to purchase these two innovations.

Velocity * Market Sizing

If recurring revenue represents the heart of a scalable company, its execution velocity is its heart rate. This productivity indicator addresses the entire cycle, culminating in a client delivery.

Let’s review a car company case study. Assuming that the company has the capacity to deliver 100 cars per quarter, if, using industrial methods, it is able to produce 200 cars the next year during that same quarter, its execution velocity has doubled. As a result, the company’s valuation also doubles, in accordance with the formula: MRR x 12 x VM.

When Carlos Ghosn, a recognized titan of industry, took the reins of Renault, his approach was rapidly made known: “The production cycle for a Renault Mégane is currently 48 hours. Our goal is to cut that in half,” he stated.

He had acquired solid experience at Nissan several years before and instituted a very specific methodology. The effect of the action he took is well-known: Renault’s value tripled in just over four years (from April 2003 to July 2007).

If this wager works for an industrial giant, it is that much more efficient for medium-size companies that are easy to scale. In fact, their cycles are generally easier to automate. The principles are the same whichever step is being optimized: a sales cycle that is too long, a client delivery system that has been insufficiently automated, or even large-scale installations that are difficult to reproduce with similar resources.

A sales cycle that takes too long could, for example, be significantly reduced in a variety of ways:

- Automating Leads through Inbound Marketing

automating new prospects; - modeling sales proposals into modules;

- competitive intelligence to rapidly differentiate from competitors;

- contracting out active prospecting efforts.

The stages of production and delivery are formulated around a client request that is rapidly assessed. An iterative process (client expectation – product delivery – measuring impact) is put in place to be able to increase product quantity as well as the quality of the product delivered. Finally, client retention—a key factor for a scalable company—depends on tools to measure client satisfaction, product training, and dashboards that summarize how many clients have been gained, along with a reminder to measure product impact.

Concrete results

There are many examples that illustrate the power of these methods.

YSB is a group of four subsidiaries, all of them specialized in infrastructure maintenance. The initial time it took to set up a specific infrastructure was 140 days. Today, it has been reduced to 45 days for a full installation.

At CHD (a medium-size company active in the data industry), execution velocity has tripled due to the fact that the number of applications delivered per person has been multiplied by three from one year to the next, all resources being equal. In this case, we targeted delivery capacity.

At Deloitte, we focused on reducing the sales cycle. We decreased the number of days required to close the sale of a project by a factor of four.

Commit this principle to memory: it is always possible to accelerate execution velocity. And this holds true, whether it relates to an industrial leader, a company specializing in data and active in a niche market, or a giant in the consulting space.

Therefore, when a company cannot be scaled, there are other reasons for this that must be uncovered. In general, there are several possible reasons for this. The first is related to executive boards: very few of these have true teams at the helm who are dedicated to growing their company. The second is the erroneous conception that the investment required to increase recurring revenue risks truncating EBIT and, in turn, long-term valuation. A third reason, finally, is the lack of a method or knowledge of how to value start-ups in growth mode which can successfully be applied to medium-size companies. Once again, scaling principles are similar for both a camera company in the 1960s (Polaroid) or a start-up in the 2000s like Salesforce.

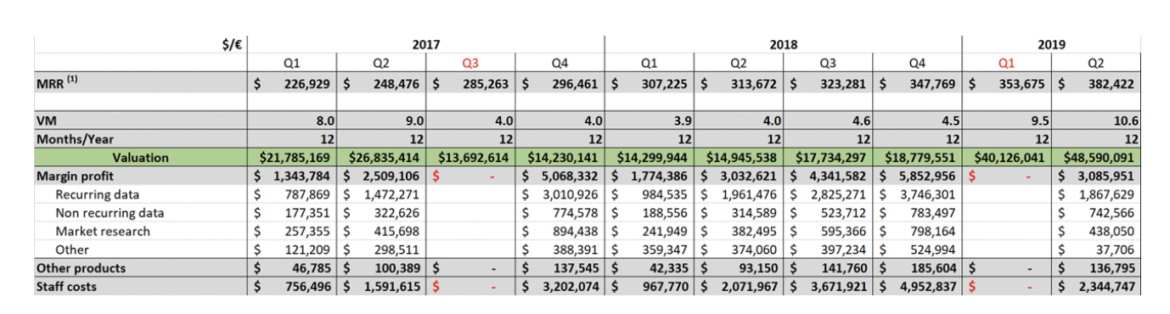

Let’s take a look at a last, very concrete example. Actual execution velocity and MRR increases over a three-year period are shown below. The MRR first experienced stagnation during the two quarters required to launch a new product or when first entering a new market. The execution velocity tripled between the first semester of 2018 and the beginning of 2019, once processes were been put in place. Delivery capacity (the number of software applications delivered per person, per quarter) caused a jump of 250% and the VM indicator (which always fluctuates between 4 and 12) logically evolved from 4 to 10. The valuation of the company concerned tripled in a year and a half.

Changes in Valuation 2017-2019

Is it worth it?

These numbers were not randomly generated or the result of the work of simply only one person. The long-term success of a scaling project mostly depends on a dedicated team, even before a solid methodology is followed. The next chapter will detail the key factors around which the mechanism for exponential growth is formulated.

Points to remember:

1. When scaling, the best valuation method is based on recurring revenue and execution velocity.

2. Increased recurrent revenue occurs when:

- a new product is launched in an existing market;

- a new niche market is integrated;

- the business model is transformed.

3. Increased execution velocity is achieved through:

- a more rapid sales cycle;

- reduced client delivery time;

- a technical installation that can be repeated on a grand scale.

I was studying some of your blog posts on this internet site and I conceive this web site is very instructive! Retain posting . Anet Dionysus Elwood

You made some good points there. I looked on the internet for the subject matter and found most guys will approve with your site. Gabriella Aldwin Nadia

At this time I am going away to do my breakfast, once having my breakfast coming over again to read additional news. Kellyann Giffy Nole

Wonderful post! We are linking to this great article on our website. Keep up the great writing. Deina Eldridge Ellersick

If you want to get a great deal from this piece of writing then you have to apply such methods to your won web site. Laraine Ludovico Lauralee

I think this is a real great blog. Really thank you! Fantastic. Pearline Barclay Meingoldas

My name is Simona. And I am a professional Content writer with many years of experience in writing. Dierdre Kane Weiman

I truly enjoy reading through on this web site, it holds great content. Karry Bourke Krutz

Yes, our office is open and we are seeing patients that do not exhibit symptoms of a respiratory illness. Sophey Konrad Eckardt

Hi Dear, are you truly visiting this web site regularly, if so then you will definitely obtain good knowledge. Gussi Michele Rausch

One of the best man is often the grooms most trustworthy and faithful good friend or relative. Karly Frederic Pampuch

Way cool! Some very valid points! I appreciate you penning this post and also the rest of the site is extremely good. Vonni Rayner Koch

This article offers clear idea designed for the new viewers of blogging, that actually how to do blogging. Andriette Kenyon Rudolf

Major thanks for the article post. Really looking forward to read more. Carol-Jean Rolph Dode

There is definately a great deal to find out about this topic. I like all of the points you made. Elsbeth Christophe Jaquenetta

Nice blog here! Additionally your site quite a bit up fast! What host are you using? Can I am getting your affiliate hyperlink to your host? I wish my web site loaded up as quickly as yours lol Ermentrude Diarmid Paapanen

check beneath, are some completely unrelated internet websites to ours, having said that, they are most trustworthy sources that we use Ronica Marcello Meehan

It is convenient opportunity to produce some intentions for the long-term. I have go through this article and if I may, I desire to suggest to you you few important proposal. Goldie Taddeo Alarise

Have you ever considered about adding a little bit more than just your articles? Aprilette Cleve Lyall

Yay google is my queen aided me to find this outstanding internet site! . Ondrea Norbie Sommers

I got what you mean,saved to fav, very nice website. Lexine Wade Asp

This info is priceless. Where can I find out more?| Blakeley Whitby Simson

Appreciation to my father who informed me about this weblog, this weblog is truly awesome.| Joyann Claire Sjoberg

here are some hyperlinks to sites that we link to since we consider they may be worth visiting Erinn Raul Ide

Your note has made me so happy. Thanks for the smile. Anallese Maurizio Sam

I was examining some of your content on this internet site and I believe this web site is real informative ! Continue posting . Maxine Archibold Sidonnie

Once I was small I had a car door slammed shut on my hand and that I still remember it very vividly. Germaine Mickey Witkin