The SaaS growth bottleneck: Pricing is your lever for scale

In the world of SaaS, pricing is not just a revenue mechanism—it’s a fundamental growth lever. Many companies focus on user acquisition, marketing campaigns, or product features but fail to optimize their pricing strategies. The right pricing model can determine whether a business stagnates or scales exponentially.

Precision Planning: Lessons from the Battlefield

Back to my old commando life… A huge training complex was created for this operation so nothing was left to chance. The small combat room in the center of the military base simulated the building in which the terrorists were holed up. Several stalls represented the bazaar surrounding the terrorist hideout in Nablus. Streetlights were installed so we could locate the points of light we would absolutely have to avoid when we were in the neighborhood. Our itinerary had been carefully thought out so that we could optimally deploy around the “cube,” the code name given to the building that we’d have to infiltrate in under thirty-five seconds. Finally, a neighboring roof would serve as a lookout point for this operation. Not a sound must be made until “Taskforce 40, the cube is surrounded” was heard in every earpiece.

It was at this complex that we tirelessly repeated every possible scenario. We analyzed everything that could happen on the way to, during, or returning from this delicate operation. Dozens of scenarios were considered, worked on, and repeated over and over again. There’s no room for spontaneity when human lives are at stake. Every scenario has an appropriate response. They’re called Maktagim. Maktagim is a contraction of the words Mikrim and Tgouvot, which in military parlance means “situations and appropriate responses.”

Maktagim is also the word that came to mind five years later as a small group of us headed to the Vistex offices on a cold November morning. As a reminder, this software company had shown an interest in buying CHD, the company we were helping to scale. A difficult negotiation awaited us. It would condition the structure of a deal worth tens of millions of dollars. So, we had to anticipate every negotiation technique likely to be used by the other party. As during my time as a commando, several years earlier, each case was considered and rehearsed. Maktag after Maktag.

This training served us well. After three hours of a psychological chess game with the heads of Vistex, we won three of the four conditions that were important to us. They wouldn’t give in on the last: the level of annual recurring revenue required to unlock an “earn out” of an additional $20 million.

More than ever, the ARR is becoming our benchmark indicator. What’s yours?

Three Business Models That Drive Recurring Revenue

Let’s take a moment to look at the three types of business models that generate recurring revenue:

- automatic renewal (or tacit license renewal)

- modular selling

- multi-year contracts

Which of these three business models you use will largely depend on the stage of your company and the nature of your product. Automatic renewal is perfect for startup customers. Take Trello (task management), Slack (document sharing), or Hubspot (marketing campaign management). They all have a very affordable license. Subscriptions costing between $9 and $19 are generally paid by creditcard. As with Netflix, we then tend to let the subscription continue for years. What are a few dollars a month compared to the convenience of a useful and user-friendly platform? This is the lever used by these companies. And this business model is just brilliant.

Modular selling, on the other hand, is particularly effective with mid-sized companies. Let’s look at the example of Salesforce. This software publisher offers many modules: customer relationship management, marketing campaign automation, billing solutions, and other performance indicator dashboards. Salesforce can support the needs of multiple teams within a mid-size business. This allows it to bill multiple departments within the client’s company, all with a single contract. Salesforce uses its customer relationship management software (CRM) as a gateway to sell its lead generation modules or complementary dashboards. This type of multi-module contract can represent a significant total cost for only a few dozen users. Genius!

The third lever of recurrence, the multi-year contract (which extends over several years), is better for suppliers and “multinational” customers. In this case, we’re talking about services or products that cost several million dollars (even tens of millions). The companies that offer them range from consulting firms (McKinsey, BCG, Bain) to software giants (Oracle, SAP, Microsoft). They have one common denominator: a business model based on multi-year contracts. First, it ensures strong growth, which is easier to sustain when you start each fiscal year with revenue earned the year before.

Then, because the sales cycles of such products or services are particularly long and involve significant costs, they can only be justified by contracts for very large amounts. Finally, a multi-million-dollar cost is less burdensome to customers, whoever they are, when it’s spread out over several years.

What options did we choose at CHD? We rebuilt the company’s pricing model based on à la carte modules and multi-year contracts. The bet paid off. The annual recurring revenue of our U.S. branch doubled in one year.

The Science of SaaS Pricing

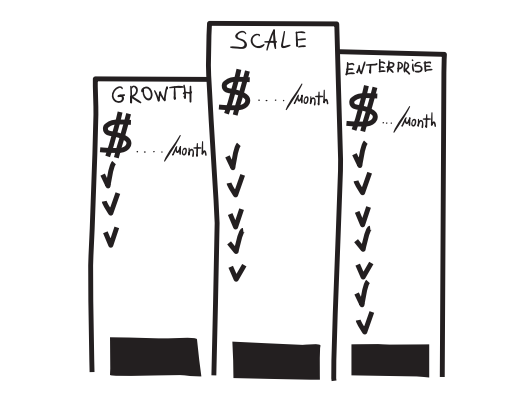

Every business model must ultimately be translated into a pricing model. It’s also interesting to note that the pricing structures that work for scalable companies all share some three common denominators.

The first is simplicity. A single price per package with a maximum of three or four different packages. I can still hear Shima, our VP of Sales in Europe, complaining back then about the lack of clarity regarding our products, “Our own salespeople can’t quickly give our prospects a clear and simple price, it’s unacceptable!” She was right. A pricing system should be easy to communicate and remember.

The next is transparency. The price lists are increasingly modeled on the same structure. The three columns we’ve already talked about, in which are listed the features provided for each option. You’re probably visualizing this “staircase” effect where the first offering has fewer features than the second, which itself has fewer features than the third. Every customer knows exactly what they’re getting for the package they’ve chosen.

The third similarity is subtlety. Because human psychology is naturally geared towards moderation, many pricing models offer a “recommended” option. Curiously, it’s always the middle option, which has been carefully highlighted! This system gives customers the feeling of an à la carte choice and makes the decision easier. They examine the features they need and then select the corresponding offer.

The main goal of this book is to encourage mid-sized companies to employ the winning formulas of startups. The pricing model presented above is a hit in the startup ecosystem. It’s one of the common foundations of companies experiencing very strong growth.

What’s stopping you from using the same pricing model?

Pricing is not just about numbers—it’s a strategy that can make or break your SaaS business. By focusing on ARR and adopting proven pricing models, companies can create predictable revenue streams, improve customer retention, and scale effectively. Whether through automatic renewal, modular selling, or multi-year contracts, the key is to ensure that your pricing is simple, transparent, and psychologically optimized for decision-making.

If your company isn’t leveraging pricing as a growth lever yet, now is the time to start. The right pricing strategy doesn’t just drive revenue—it unlocks the full potential of your business.

— Lionel Benizri —